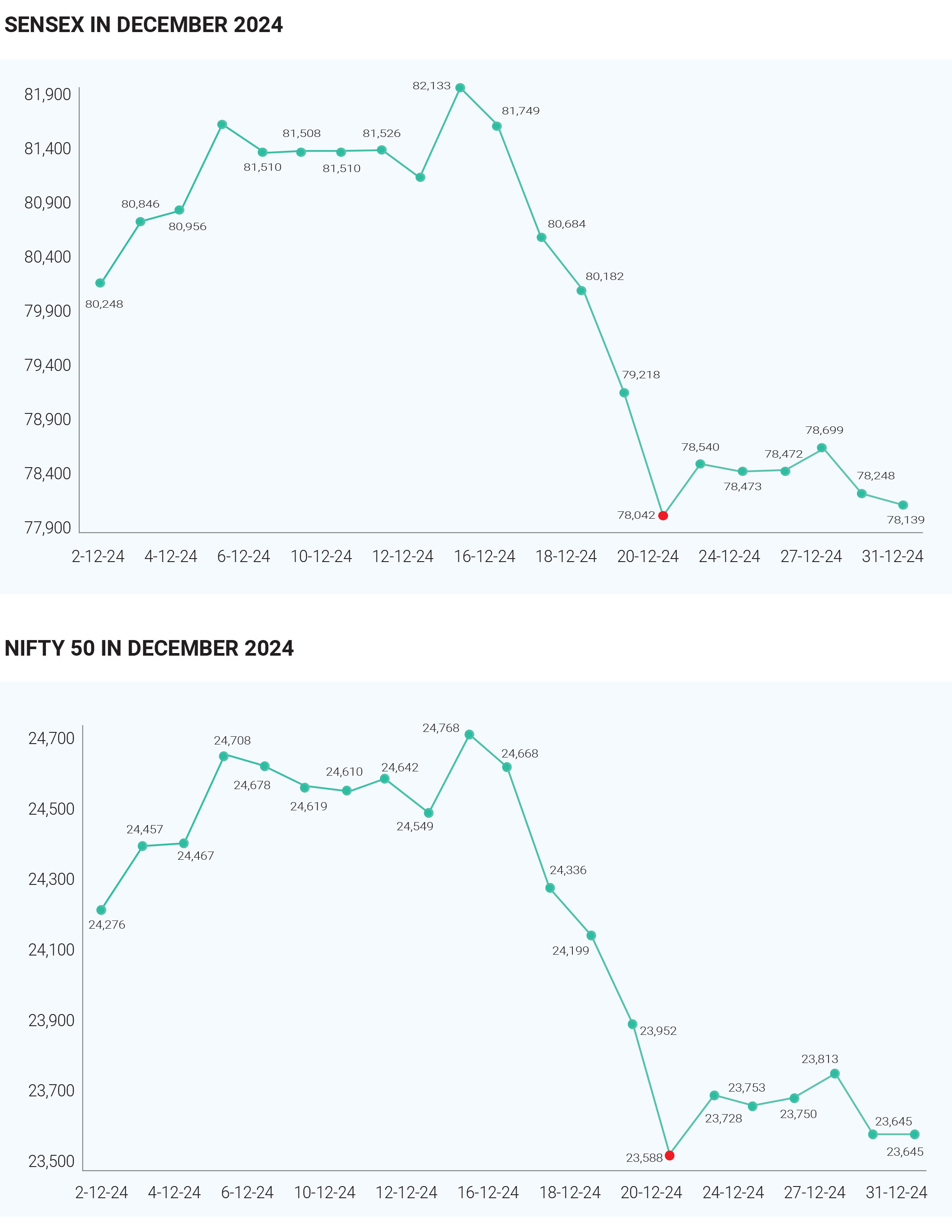

In December 2024, Sensex and Nifty, experienced a mixed performance, concluding the year with notable gains despite facing challenges in the final quarter. Sensex closes at 78139.01 down by 109.12 points for the last month of the year, whereas it has gained 8.18% in the year 2024. Nifty ended up at 23658.15 up by 13.25 points for December 2024, but it has also ended with annual gain of 8.76%. Indian markets marked their ninth consecutive year of positive returns, with the Sensex touched the highest of 85978.35 and Nifty touched 26277.35 during the 2024. In December 2024, several key events significantly influenced the performance of the Indian stock market. The FED rate cuts, the US-China trade conflicts and poor Indian economic numbers, these factors influenced the markets in last month of 2024. On December 18, 2024, the FED announced a 25 basis point cut, lowering its benchmark rate to a range of 4.25% to 4.50%. This was the third consecutive rate cut of the year, reflecting the FED’s attempt to support economic growth amid persistent inflation concerns and a slowing economy. After this announcement, global markets reacted negatively. On December 19, both the Sensex and Nifty experienced sharp declines, with the Sensex dropping by 964.15 points and the Nifty falling by 364.20 points. This sell-off was attributed to investor concerns about the FED's cautious outlook on future rate cuts, which suggested that further easing would be slower than previously expected. Also Federal Reserve indicated it might implement only two more cuts in 2025 led to increased uncertainty among investors. The cautious tone from FED Chair Jerome Powell regarding future policy adjustments contributed to fears of a more restrictive monetary environment than anticipated, causing investors to reassess their positions in equities. The ongoing U.S.-China trade tensions had a multifaceted impact on the Indian stock markets, particularly in December 2024. As the trade war escalated, many investors began to view Indian equities as a safer alternative to Chinese stocks. For instance, CLSA increased its allocation to Indian equities, citing India's relative insulation from U.S. tariffs compared to China. This shift was driven by the perception that India could benefit from supply chain disruptions affecting China, making it an attractive investment destination amidst global uncertainty. The imposition of high tariffs on Chinese goods by the U.S. created opportunities for Indian exporters to fill the gaps left in the market. Indian companies in sectors like textiles and pharmaceuticals were positioned to benefit from increased demand as U.S. consumers sought alternatives to Chinese products.

This potential boost in exports was seen positively by investors, contributing to a more favourable outlook for certain sectors within the Indian market. Despite these opportunities, the overall sentiment in the Indian stock market remained cautious due to the broader implications of U.S.-China tensions on global economic stability. The uncertainty surrounding trade policies led to volatility in the markets, with both Sensex and Nifty experiencing fluctuations as investors reacted to news related to tariffs and trade negotiations. Sector performance in December showed mixed results. Sectors like metals, pharmaceuticals, IT, and real estate demonstrated resilience, while FMCG struggled due to weak growth projections from companies such as Godrej Consumer Products. Although the festive season typically boosts consumer spending, broader economic challenges tempered performance. Mid-cap stocks outperformed large-caps, with the BSE MidCap index showing positive returns, driven by stronger domestic institutional investments and a favourable outlook for smaller companies. Similarly, small-cap stocks performed well, with the BSE SmallCap index recording significant gains throughout the year. This segment benefited from niche market opportunities and growing consumer demand, attracting retail investors seeking higher growth potential amidst volatility in large-cap stocks. In December 2024, Foreign Institutional Investors (FIIs) played a significant role in the Indian stock markets, reversing a trend of heavy selling from previous months. The first two weeks of December saw FIIs make net investments ranging from ₹22,766 crore to ₹24,454 crore, signalling renewed interest in Indian equities. This shift was driven by attractive valuations and growing expectations of rate cuts by the U.S. Federal Reserve. The influx of foreign capital helped fuel a rally in large-cap stocks, particularly in sectors like banking and IT. FIIs’ positive sentiment was a crucial factor supporting overall market performance. However, despite the strong inflows, FIIs remained cautious. On certain days, they were large sellers, indicating that at elevated price levels, they might revert to selling due to concerns over high valuations in India relative to other markets, as well as the potential impact of a rising dollar. The renewed interest from FIIs particularly benefited sectors that had previously faced pressure, with the banking sector seeing increased investments. Investors viewed the sector as reasonably valued and poised for growth, supported by rising domestic institutional and retail investments. Overall, the FII inflows in December 2024 provided a much-needed boost to the Indian equity market. Overall, December 2024 was marked by significant volatility driven by external economic factors, geopolitical tensions, and domestic economic indicators, leading to a challenging environment for both Sensex and Nifty indices.

The Indian debt market demonstrated robust performance in December 2024, underpinned by several favourable trends and strategic policy decisions. Corporate bond issuance saw a record-breaking surge, with Indian companies raising ₹10.67 trillion (around $124.81 billion) by December 27, marking a 9% year-on-year increase. This boost in fundraising was fuelled by a stable economic climate, declining bond yields, and a strong investor appetite for long-term debt instruments. The increased demand for corporate bonds highlighted the attractive borrowing conditions for firms in a favourable macroeconomic environment. Debt mutual funds also showed strong results, with many schemes posting high single-digit returns. Gilt Funds and Corporate Bond Funds focusing on medium to long-term maturities generated average returns exceeding 9%. Short-duration funds delivered solid returns as well, slightly surpassing those of 2023. These positive returns reflected an overall healthy market for debt investments, driven by demand for stable income and long-term capital preservation. The benchmark 10-year government bond yield witnessed its sharpest decline in four years, falling within the range of 6.7% to 7.2%. This drop was attributed to strong demand for government securities, driven by factors such as fiscal discipline, a lower fiscal deficit, and expectations of future interest rate cuts by the Reserve Bank of India (RBI). Investors were particularly encouraged by India's favourable debt-to-GDP ratio, which instilled confidence in the stability of the country’s debt market. The RBI played a crucial role in maintaining market stability throughout December. The central bank’s decision to keep interest rates steady contributed to lower yields on government securities, as the stability helped drive demand for bonds. Additionally, the RBI’s outlook on interest rates, signalling a stable or declining trend, made existing bonds with higher coupon rates more attractive to investors. This shift led to capital gains for bondholders, adding a layer of support to the debt market. The RBI also managed liquidity carefully, using Open Market Operations (OMOs) and other tools to stabilize financial conditions. By injecting liquidity into the system, especially during periods of market stress, the RBI ensured that the debt market remained liquid and functional. These actions provided much-needed stability, reinforcing investor confidence in the bond market. A significant development in December was the Federal Reserve’s decision to cut its interest rate by 25 basis points to a target range of 4.25% to 4.50%. Initially, the announcement sparked positive sentiment in global markets, including India, as lower U.S. interest rates tend to make emerging market debt more attractive. However, the Fed’s guidance on fewer rate cuts in 2025 than initially expected tempered optimism, leading to increased caution among investors. Despite this, the decline in U.S. interest rates and the subsequent dip in yields on government securities in India attracted strong demand for bonds. The RBI’s actions complemented global trends by managing domestic liquidity effectively. The central bank's prior reduction of the Cash Reserve Ratio (CRR) played a key role in absorbing some of the volatility triggered by global market movements and U.S. monetary policy. This ensured that liquidity remained stable, cushioning the impact of potential capital outflows from emerging markets due to global uncertainties. To summarise December 2024 witnessed a strong performance from the Indian debt market, marked by robust corporate bond issuance, healthy returns from debt mutual funds, and favourable macroeconomic conditions. The RBI's effective management of liquidity and interest rates played a crucial role in maintaining market stability, while global factors such as the Fed’s rate cut contributed to a positive sentiment in India’s debt market. Despite challenges, including global inflation pressures and cautious investor sentiment, India’s debt market ended the year on a high note, showcasing its resilience amidst global economic volatility.

Crude oil prices saw notable fluctuations in December 2024, influenced by a mix of supply-demand dynamics, geopolitical tensions, and economic conditions. Brent Crude ranged between $74 and $90 per barrel, settling at $74.64 on the last trading day of the year. This marked a 3% decline from the previous year’s closing price of $77.04. Oversupply was a key factor driving the decline, with increased production from the U.S. and non-OPEC countries outpacing demand. OPEC’s decision to maintain production levels despite declining prices contributed to this surplus. Recovery in demand post-pandemic was hindered, especially due to economic slowdowns in major economies like China. While China’s manufacturing activity showed signs of growth, overall demand remained weak, causing concerns about future consumption. Geopolitical tensions, particularly U.S. military actions linked to Iran-backed threats affecting shipping routes, caused short-term volatility but had little impact on the overall supply-demand balance. The global market also reacted to pessimistic economic signals, which led traders to revise their oil demand outlook. Despite declines in U.S. crude stocks, which typically support prices, these gains were often offset by supply concerns. In conclusion, December’s crude oil prices were shaped by a complex blend of seasonal factors, geopolitical instability, economic indicators, and supply-demand imbalances, highlighting the ongoing uncertainty in the global energy market.

The performance of the Indian bullion market in December 2024 was shaped by a range of global and domestic factors, including economic conditions, geopolitical tensions, central bank actions, seasonal demand, inflationary pressures, currency fluctuations, and import trends. A major factor influencing bullion

prices was the anticipation of a 25-basis-point interest rate cut by the U.S. Federal Reserve. Lower interest rates typically boost the appeal of non-yielding assets such as gold and silver, prompting investor interest in these precious metals. Geopolitical developments, including tensions surrounding North Korea and Russia, provided further support to gold prices as investors flocked to safe-haven assets. In addition, China’s central bank resumed gold purchases after a six-month pause, signalling robust demand from central banks, which plays a significant role in driving global gold prices. December is a month marked by increased demand for gold in India, driven by the wedding season and festivals. Retailers typically stock up on inventory to meet consumer needs, creating upward pressure on prices. Additionally, inflation concerns played a role, as higher inflation generally leads to greater demand for gold as a hedge against rising prices. Fluctuations in inflation data affected market sentiment and expectations regarding future monetary policy decisions. The performance of the U.S. dollar also had an impact, as a stronger dollar can make gold more expensive for holders of other currencies, potentially reducing demand. India’s gold imports followed a cyclical trend, with a significant drop in December 2024 after record-high imports in November. Early in December, gold prices remained relatively stable, with 24K gold priced at ₹78,030 per 10 grams on December 18. However, geopolitical concerns and market volatility led to fluctuations in the latter part of the month. By December 27, gold prices increased for three consecutive days, reaching ₹77,890 per 10 grams in Delhi, supported by heightened tensions in the Middle East that drove investors to seek safety in gold. As December drew to a close, gold prices saw a slight decline, falling to ₹78,003 per 10 grams in Delhi on December 30, amid lower trading volumes due to the holiday season. On December 31, gold prices further dipped to ₹75,500 per 10 grams in Mumbai and ₹75,710 in Delhi, reflecting a ₹420 decrease from the previous day. This downward trend was primarily driven by profit-taking among investors and market adjustments due to broader global conditions. Silver prices mirrored gold’s performance, starting strong but facing fluctuations throughout the month. On December 18, silver was priced at ₹92,500 per kg. By December 27, silver saw a modest increase to ₹91,700 per kg, driven by firm global trends and some industrial demand. However, by December 31, silver prices dropped to ₹87,310 per kg in Delhi, following a broader decline across precious metals as traders adjusted their positions toward the year’s end. To summarise, gold and silver prices in December 2024 initially rose due to safe-haven demand fuelled by geopolitical tensions, but ultimately faced declines by month-end due to profit-taking and the seasonal slowdown in trading activity. The bullion market in India remained influenced by both global economic factors and domestic seasonal demand throughout the month.

In December 2024, the Indian rupee (INR) saw fluctuations against the U.S. dollar (USD), driven by a range of economic and geopolitical factors. The exchange rate started the month at ₹85.12 per USD on December 2, showing some initial stability. By December 20, it slightly adjusted to ₹85.04, and by December 24, the rupee depreciated further to ₹85.16. By the end of the month, on December 31, the INR stood at ₹85.60 per USD, reflecting a 0.15% increase from the prior day and a 2.92% decline from the previous year, when the exchange rate was ₹83.17. A key factor influencing the rupee was the U.S. Federal Reserve’s 25 basis point rate cut in mid-December. While a weaker dollar typically benefits emerging market currencies, uncertainty surrounding future rate cuts led to mixed investor sentiments. Domestic factors, such as inflation rates and trade balances, also played a role in shaping investor confidence in the rupee. Expectations of tighter monetary policies from the Reserve Bank of India (RBI) due to rising inflation added pressure. Additionally, fluctuating foreign institutional investor (FII) inflows and outflows affected the rupee’s movement. Overall, the rupee experienced moderate depreciation, closing at ₹85.60 per USD by December’s end.

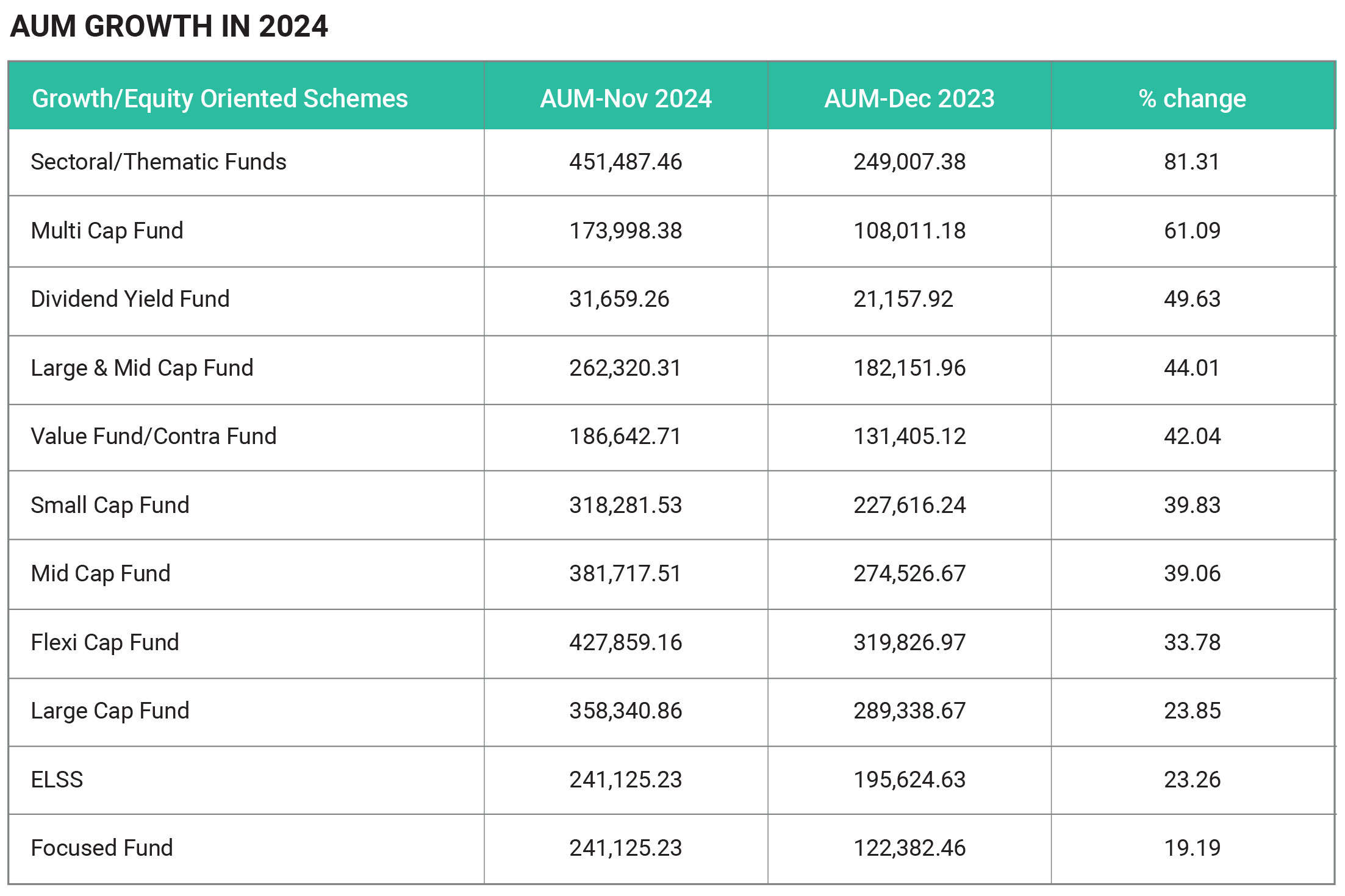

In December 2024, the Indian mutual fund industry saw impressive growth, driven by a sharp rise in assets under management (AUM) and strong inflows from retail investors. The AUM reached ₹69 lakh crore by the end of December 2024, reflecting a remarkable increase of 35.5% from ₹50.24 lakh crore in December 2023. A significant contributor to this growth was the surge in systematic investment plan (SIP) contributions, which hit ₹25,320 crore by November 2024, up 44% from ₹17,610 crore in December 2023. This trend indicates that retail investors are increasingly embracing disciplined and regular investing strategies. The total SIP AUM reached a record ₹13.54 lakh crore, showcasing the growing popularity of this investment approach across Indian households. Equity funds, especially mid-cap and small-cap schemes, outperformed other categories, benefitting from a favourable market environment. Both the Nifty Midcap 100 and Nifty Small cap 100 indices saw strong gains, enhancing the performance of equity mutual funds. Active equity schemes witnessed record inflows of around ₹3.5 trillion, more than doubling the previous year's figure of ₹1.6 trillion, with SIPs contributing nearly ₹2 trillion. The industry also added about 9.8 million new investors in the first eleven months of 2024, raising the total number of unique investors to around 51.8 million by November. Thematic funds, particularly those focused on sectors like technology and healthcare, attracted substantial inflows, benefiting from the ongoing economic recovery. On the other hand, debt funds saw a sharp decline in inflows, with November 2024 recording a 92% drop compared to the previous month. Despite this, 2024 witnessed a record number of fund launches, with 153 equity schemes introduced, further diversifying options for investors. to around 51.8 million by November. Thematic funds, particularly those focused on sectors like technology and healthcare, attracted substantial inflows, benefiting from the ongoing economic recovery. On the other hand, debt funds saw a sharp decline in inflows, with November 2024 recording a 92% drop compared to the previous month. Despite this, 2024 witnessed a record number of fund launches, with 153 equity schemes introduced, further diversifying options for investors.

The Indian insurance industry showed impressive growth and resilience in December 2024, fuelled by multiple factors across both life and non-life sectors. The sector is expected to grow at an average annual rate of 7.1% between 2024 and 2028, positioning India as one of the fastest-growing insurance markets in the G20. This expansion is largely due to a favourable economic environment, increasing demand from the expanding middle class, and supportive regulatory frameworks. In the life insurance segment, new business premiums rose by 15.67%, driven by a surge in demand for life coverage, especially among the middle-income demographic. Rising awareness and the integration of technology in insurance services, or insurtech, have also contributed to this growth. However, overall growth for FY24 is projected at 4.1%, a slowdown from 5.9% in FY23. This is attributed to reduced risk awareness following the pandemic and changes in tax policies affecting high-value policies. The non-life insurance segment, on the other hand, is set to grow by 8.3%, boosted by improvements in distribution networks and government support. Health insurance premiums are expected to rise by 9.7%, reflecting growing coverage needs. Despite challenges such as inflation and high-interest rates impacting consumer spending, the non-life sector is anticipated to experience double-digit growth in 2025 due to regulatory changes and new, innovative products. A notable development in December was the General Insurance Corporation of India (GIC) stock price increase by 25.81% over the month, outperforming broader market indices. However, challenges such as low insurance penetration—estimated at 3.8%—and a substantial protection gap, with 93% of natural disaster risks uninsured, persist. Cyber insurance emerged as a key trend in 2024, with rising demand as businesses become more aware of the risks posed by cyber threats. Overall, December marked a period of optimism and growth for India’s insurance sector, with significant increases in premiums across both life and non-life insurance

Donald Trump's Inauguration

On 20th January 2025, the inauguration of

President-elect Donald Trump is anticipated to create

uncertainty regarding U.S. policies on trade, immigration,

and diplomacy. Market watchers will closely monitor his

administration's approach, as any significant shifts could

have ripple effects on the Indian equity market.

US Federal Reserve Meeting

U.S. Federal Reserve interest rate decisions, will continue

to influence investor sentiment in India. After Trump

administration markets expects significant changes in

global markets or trade relations could lead to volatility in

Indian stocks.

Union Budget 2025

The Union Budget will detail the government's fiscal

policies and spending plans for the upcoming year.

Investors will be keenly focused on measures aimed at

driving growth, boosting infrastructure investment, and

supporting key sectors such as consumption and

finance. Positive announcements in these areas have the

potential to enhance market sentiment and provide a

boost to investor confidence.

Monetary Policy by RBI

Reserve Bank of India (RBI) might consider cutting

interest rates by February 2025 if inflation stabilizes. A

rate cut would lower borrowing costs and potentially

boost sectors such as housing and consumption,

positively influencing market performance.

Indian State Elections

With key state elections approaching, market sentiment

may be influenced by the outcomes and their impact on

policy continuity. Investors will focus on whether the

results strengthen the central government’s mandate,

which could pave the way for stronger economic

reforms. A decisive win may boost confidence in the

government's ability to implement policy changes, while

uncertainty could lead to short-term volatility in equity

markets. As the elections unfold, both businesses and

investors should closely monitor developments,

weighing the potential for reform against the risks of

political instability

Geopolitical Tensions

Ongoing geopolitical tensions, particularly between

Ukraine and Russia, as well as Iran and Israel, will be

closely watched. Additionally, trade dynamics between

the US and China are expected to influence the Indian

markets. Any developments, whether resolutions or

escalations, in these conflicts could disrupt global

supply chains and impact energy prices, thereby

affecting Indian investors.

Corporate Results for Q4 FY25

The performance of corporate earnings in Q4 FY25 will

play a critical role in shaping market expectations.

Analysts are cautious about potential earnings

slowdowns, which could undermine investor confidence

if companies report disappointing results.

Inflation Trends

Persistent inflationary pressures, particularly from food

prices, may influence RBI's monetary policy decisions. If

inflation remains high, it could delay interest rate cuts

and affect consumer spending, thereby impacting

corporate earnings and stock valuations

Copyright © 2021 Fintso