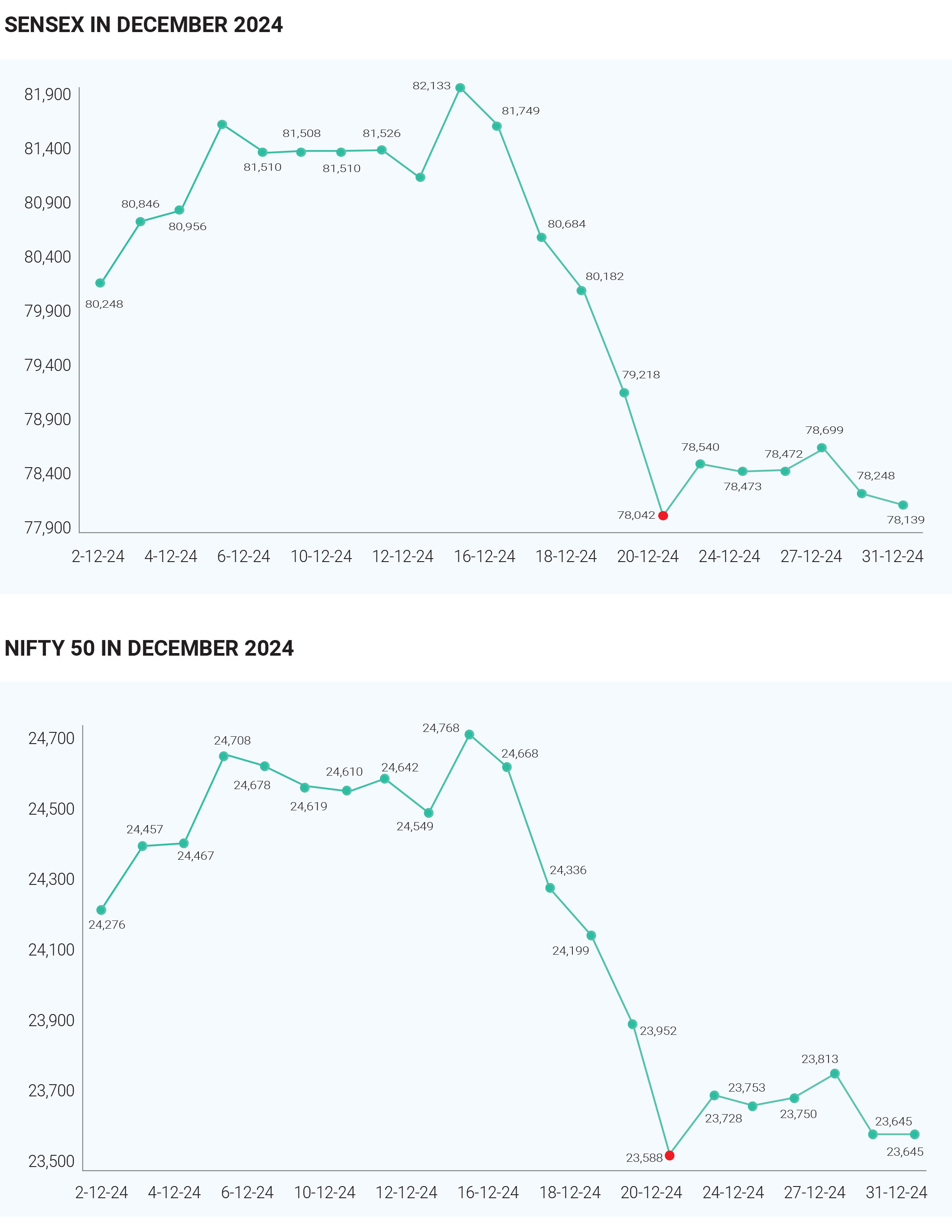

In December 2024, Sensex and Nifty, experienced a mixed performance, concluding the year with notable gains despite facing challenges in the final quarter. Sensex closes at 78139.01 down by 109.12 points for the last month of the year, whereas it has gained 8.18% in the year 2024. Nifty ended up at 23658.15 up by 13.25 points for December 2024, but it has also ended with annual gain of 8.76%. Indian markets marked their ninth consecutive year of positive returns, with the Sensex touched the highest of 85978.35 and Nifty touched 26277.35 during the 2024. In December 2024, several key events significantly influenced the performance of the Indian stock market. The FED rate cuts, the US-China trade conflicts and poor Indian economic numbers, these factors influenced the markets in last month of 2024. On December 18, 2024, the FED announced a 25 basis point cut, lowering its benchmark rate to a range of 4.25% to 4.50%. This was the third consecutive rate cut of the year, reflecting the FED’s attempt to support economic growth amid persistent inflation concerns and a slowing economy. After this announcement, global markets reacted negatively. On December 19, both the Sensex and Nifty experienced sharp declines, with the Sensex dropping by 964.15 points and the Nifty falling by 364.20 points. This sell-off was attributed to investor concerns about the FED's cautious outlook on future rate cuts, which suggested that further easing would be slower than previously expected. Also Federal Reserve indicated it might implement only two more cuts in 2025 led to increased uncertainty among investors. The cautious tone from FED Chair Jerome Powell regarding future policy adjustments contributed to fears of a more restrictive monetary environment than anticipated, causing investors to reassess their positions in equities. The ongoing U.S.-China trade tensions had a multifaceted impact on the Indian stock markets, particularly in December 2024. As the trade war escalated, many investors began to view Indian equities as a safer alternative to Chinese stocks. For instance, CLSA increased its allocation to Indian equities, citing India's relative insulation from U.S. tariffs compared to China. This shift was driven by the perception that India could benefit from supply chain disruptions affecting China, making it an attractive investment destination amidst global uncertainty. The imposition of high tariffs on Chinese goods by the U.S. created opportunities for Indian exporters to fill the gaps left in the market. Indian companies in sectors like textiles and pharmaceuticals were positioned to benefit from increased demand as U.S. consumers sought alternatives to Chinese products.

This potential boost in exports was seen positively by investors, contributing to a more favourable outlook for certain sectors within the Indian market. Despite these opportunities, the overall sentiment in the Indian stock market remained cautious due to the broader implications of U.S.-China tensions on global economic stability. The uncertainty surrounding trade policies led to volatility in the markets, with both Sensex and Nifty experiencing fluctuations as investors reacted to news related to tariffs and trade negotiations. Sector performance in December showed mixed results. Sectors like metals, pharmaceuticals, IT, and real estate demonstrated resilience, while FMCG struggled due to weak growth projections from companies such as Godrej Consumer Products. Although the festive season typically boosts consumer spending, broader economic challenges tempered performance. Mid-cap stocks outperformed large-caps, with the BSE MidCap index showing positive returns, driven by stronger domestic institutional investments and a favourable outlook for smaller companies. Similarly, small-cap stocks performed well, with the BSE SmallCap index recording significant gains throughout the year. This segment benefited from niche market opportunities and growing consumer demand, attracting retail investors seeking higher growth potential amidst volatility in large-cap stocks. In December 2024, Foreign Institutional Investors (FIIs) played a significant role in the Indian stock markets, reversing a trend of heavy selling from previous months. The first two weeks of December saw FIIs make net investments ranging from ₹22,766 crore to ₹24,454 crore, signalling renewed interest in Indian equities. This shift was driven by attractive valuations and growing expectations of rate cuts by the U.S. Federal Reserve. The influx of foreign capital helped fuel a rally in large-cap stocks, particularly in sectors like banking and IT. FIIs’ positive sentiment was a crucial factor supporting overall market performance. However, despite the strong inflows, FIIs remained cautious. On certain days, they were large sellers, indicating that at elevated price levels, they might revert to selling due to concerns over high valuations in India relative to other markets, as well as the potential impact of a rising dollar. The renewed interest from FIIs particularly benefited sectors that had previously faced pressure, with the banking sector seeing increased investments. Investors viewed the sector as reasonably valued and poised for growth, supported by rising domestic institutional and retail investments. Overall, the FII inflows in December 2024 provided a much-needed boost to the Indian equity market. Overall, December 2024 was marked by significant volatility driven by external economic factors, geopolitical tensions, and domestic economic indicators, leading to a challenging environment for both Sensex and Nifty indices.