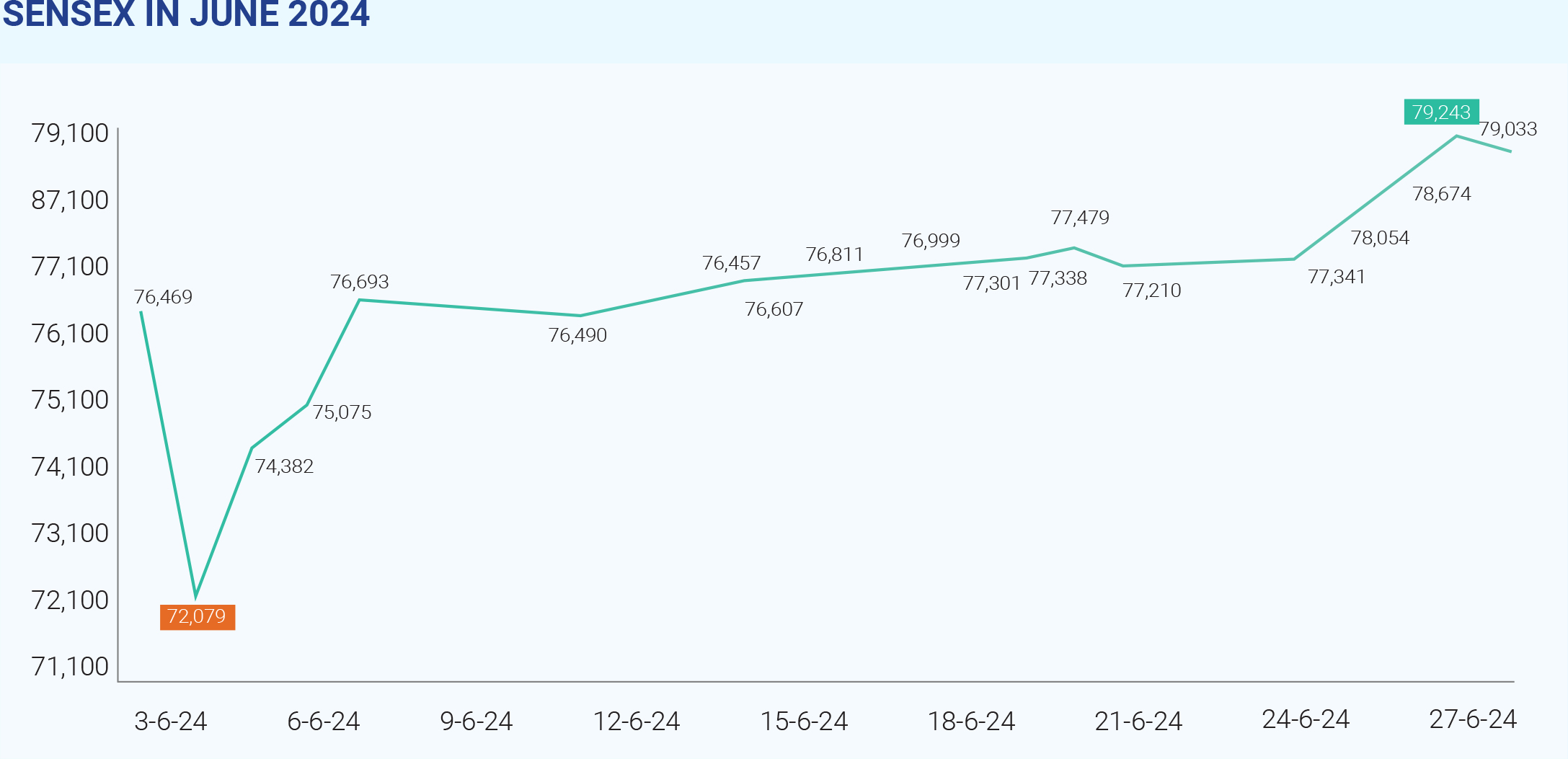

The Indian stock market took a wild ride in early June, mirroring the unexpected outcome of the Lok Sabha elections. When results were announced on June 4th, the market plunged – the Nifty 50 index dipped over 5.9% and the Sensex fell 5.7%. This sharp sell-off reflected investor jitters about a hung parliament, with Prime Minister Modi's BJP failing to secure an outright majority and needing to form a coalition government. However, this market panic proved short-lived. Within days, a remarkable recovery unfolded. Over the following nine trading sessions, the Nifty and Sensex surged over 7%, reaching all-time highs. This swift rebound showcased the market's underlying resilience and its faith in India's long-term growth trajectory, even amidst short-term political uncertainties. The initial investor unease stemmed from concerns about the new government's ability to continue Modi's pro-business agenda. With a coalition government, there were worries about potential delays or modifications to economic reforms. However, these anxieties were somewhat quelled by the BJP-led alliance retaining control of key ministries like finance, railways, and commerce. The future direction of the market hinges heavily on the stability and policies of the new coalition. Market experts anticipate the focus to shift towards the government's economic agenda, with hopes pinned on the upcoming Union budget, the positive progress of the monsoon season, and continued foreign investments. Despite the initial volatility, India's long-term market prospects remain bright. Favourable

demographics, steady economic expansion, and the

country's growing global influence paint a compelling

picture for future growth. Notably, sectors like real estate,

private banks, telecom, auto, insurance, and IT

outperformed in June, buoyed by a combination of

positive economic conditions, supportive government

policies, and individual company developments.

June 2024 witnessed a significant shift in the Indian

stock market with Foreign Institutional Investors (FIIs)

turning net buyers. This positive turn comes after two

months of net selling, where FIIs pulled out over ₹34,257

crore (around $4.4 billion) in April and May. The return of

FII interest can be attributed to several key factors like -

formation of a new government, albeit a coalition,

instilled a sense of stability following the Lok Sabha

elections, continuation of good governance and policy

reforms, India's sustained economic growth and positive

GDP projections, impressive corporate earnings reports

and lastly stronger forecasts for India's current account

surplus and its relative outperformance compared to

markets like China and Brazil. Interestingly, FII buying

was concentrated in specific sectors during the first half

of June. Real estate, telecom, and financials saw net

inflows, while IT, metals, and oil & gas experienced net

selling. This suggests a strategic shift by FIIs, moving

funds towards sectors they perceive to offer better

opportunities in the Indian market.

The Indian rupee defied expectations in June 2024,

proving more resilient than most Asian currencies. This

strength stemmed from a confluence of positive factors.

The inclusion of Indian bonds in the prestigious

JPMorgan emerging market bond index triggered billions

of dollars to flow into the country. This translated to over

$8.1 billion in FII inflows into the debt market, bolstering

the rupee. For the first time in ten quarters, India's current

account balance tipped into surplus in Q4 FY2024. This

shift, fueled by a rise in service exports and private

transfer receipts, further strengthened the rupee's

position. The Reserve Bank of India's measured

interventions in the foreign exchange market played a

crucial role. By strategically buying and selling dollars,

the RBI prevented the rupee from appreciating too

quickly while still providing support. Market expectations

for aggressive interest rate cuts by the US Federal

Reserve softened in June. This shift, with fewer

anticipated hikes in the dollar, eased pressure on other

currencies, including the rupee. Overall, June 2024

painted a bright picture for the Indian rupee. Strong

fundamentals, a surge in foreign investment, and a

supportive central bank all contributed to its impressive

performance.

June 2024 presented a mixed picture for oil prices. While

the first half of the year saw a significant increase, June

itself offered a more volatile story. The continual trend

that began in the first half, WTI crude oil futures climbed

roughly 6% in June, marking a total rise of over 13% for

the year so far. Brent crude, the global benchmark, also

witnessed a gain of 1.88% in June. OPEC+'s decision to

gradually increase oil production later in the year,

coupled with continued low demand, particularly in

developed economies, put downward pressure on prices.

Additionally, rising global oil inventories added to the

bearish sentiment. A significant drawdown in U.S. crude

inventories in June countered the downward trend,

leading to a price increase of nearly 3% for the month.

This upward momentum is expected to continue in the

near future before potentially moderating later in the

year. On the domestic front, crude oil prices in India

mimicked the global trend, rising throughout June,

however stayed below the peak levels reached in March

2024. Overall, June was a month of conflicting forces in

the oil market. While global factors like OPEC+ plans and

sluggish demand threatened to dampen prices, a

surprise drawdown in U.S. inventories provided a

temporary boost. The near future is likely to see a

continuation of this tug-of-war between supply and

demand.

Gold prices in India exhibited relative stability throughout

June 2024. There was a price increase of ₹700 for 10

grams of 22-carat gold and ₹760 for 10 grams of 24-carat

gold on June 4th, 2024. This resulted in prices reaching

₹65,718 for 22-carat and ₹71,744 for 24-carat gold.

Favourable global economic conditions, balanced

demand and supply, stable interest rates and inflation

and absence of major seasonal factors are the several

factors which contributed towards the current trend. The

future trajectory of gold prices depends widely on

interest rates in both India and the US and the progress of

the monsoon and upcoming festivals. In essence, June

2024 saw gold prices in India remain largely steady, with

a minor increase on June 4th.

Despite a month marked by both record highs and lows,

the Indian market managed to find stability towards the

end of June. While some sectors thrived in the wake of

the election results, others remain undervalued. While

concerns linger regarding political uncertainty and

potential policy shifts, positive economic data and strong

corporate performance are offering investors a

temporary reprieve. However, July demands a watchful

eye. The upcoming Budget 2024 and the implementation

of new regulations from July 1st, aimed at strengthening

market governance, introduce fresh elements of

uncertainty.

Following the introduction of cashless insurance premiums, the Insurance Regulatory and Development Authority of India (IRDAI) announced a new provision on June 12th. This provision aims to provide a fairer deal for life insurance policyholders who are unable or unwilling to continue paying their premiums. This new rule, based on a consultation paper released in December, guarantees a better "surrender value" for policyholders who choose to exit their plans. Previously, policyholders who stopped paying premiums might receive minimal or no payout. The IRDAI has mandated that insurers, when calculating surrender value, must ensure "reasonableness and value for money" for both policyholders who continue their plans and those who choose to exit. In simpler terms, this means policyholders who need to discontinue their life insurance plans will receive a more significant payout under the new provision. This change offers greater flexibility and financial security for policyholders. Some key takeaways from this provision can be listed down to understand its benefits to the life policyholders:

- IRDAI has mandated that life insurers must now offer a special surrender value (SSV) after the first policy year, provided one full year's premium has been received. For policies with limited premium payment terms of less than 5 years and single premium policies, the SSV becomes payable immediately.

- The SSV must at least equal to the expected present value of the paid-up sum assured, paid-up future benefits, and accrued benefits. Insurers can now offer higher Guaranteed Surrender Values (GSV) than the minimum specified, based on factors like premium size, term, and policy duration.

- The surrender value percentages are structured as: 30% of total premiums paid if surrendered in the second year, 35% in the third year, and 50% between the fourth and seventh years. It remains at 90% in the last two years.

Despite moderate growth in life insurance during 2023-24, the future looks bright. Industry projections suggest annual growth exceeding 6% between 2024-28. This optimism stems from rising incomes, growing public awareness of insurance benefits, and supportive government initiatives. However, a significant challenge remains – a vast "protection gap" where 93% of potential risks are uninsured. The new IRDAI regulations address this gap and lay the groundwork for a stronger Indian insurance sector. These provisions target the commission structures of agents and intermediaries, aiming to create a more transparent, efficient, and customer-centric distribution system. By promoting fair, reasonable, and ethical practices, the regulations empower agents to act in the best interests of policyholders. Additionally, this focus on efficiency is expected to drive down costs and premiums, ultimately benefiting consumers. In essence, these changes pave the way for a more inclusive and robust insurance market in India.

Copyright © 2021 Fintso